Sarina Govindaiah, an American University junior who lives in the Berkshire Apartments, knew finding affordable housing in Washington, especially near campus was difficult.

What she didn’t know is that her landlord, along with many others in the district, would be sued by the D.C. attorney general for colluding to fix rent prices.

D.C. Attorney General Brian Schwalb filed a lawsuit in November 2023 against 14 of the biggest landlords in the district as well as RealPage, Inc., according to a legal complaint. The software company RealPage provides software that collects data and recommends rent prices to landlords.

Govindaiah shares an 800-square-foot, one-bedroom apartment in the Berkshire where she and her roommate pay $2,232 a month. Govindaiah said many other students she knows living in the Berkshire complain about rodents and don’t like living there, but stay because they lack other options.

“I think a lot of people feel forced into living there because they’re like, ‘Where else do I go?’” Govindaiah said.

The legal complaint, written by the Office of the Attorney General for the District of Columbia, characterizes the group of landlords as a cartel. The complaint alleges that the landlords violated antitrust laws by colluding to raise rents by as much as 2% to 7%.

Lawyers representing each of the property management companies did not respond to requests for comment. AvalonBay Communities, Inc, Highmark Residential, LLC and JBG Associates, LLC—three of the landlords listed as defendants in the suit—have petitioned the court to dismiss the complaint. RealPage did not respond to AWOL requests for comment.

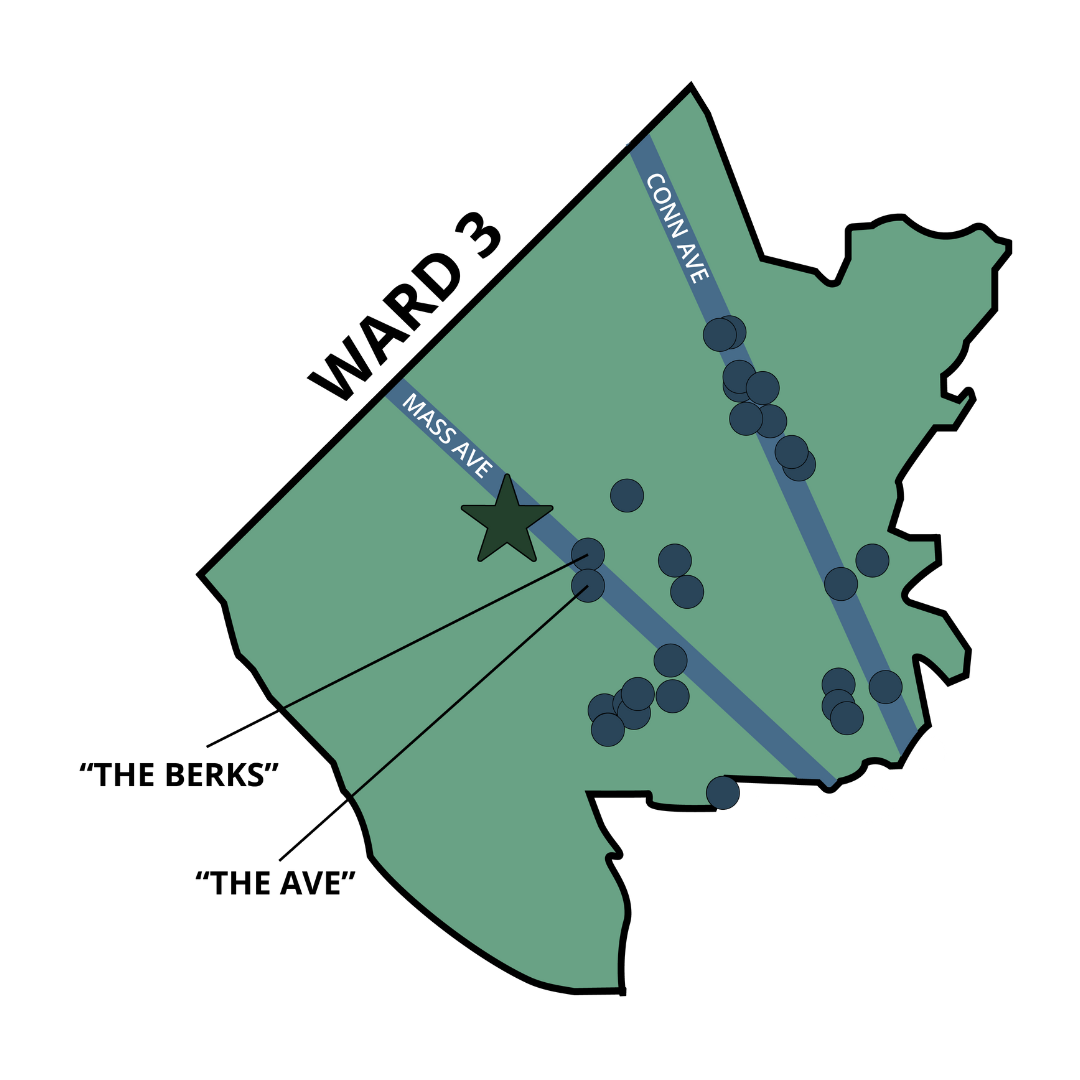

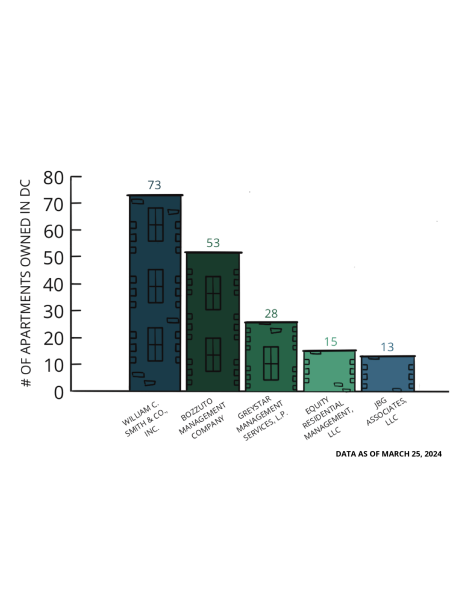

Although it refers to landlords, the lawsuit is against large landlord companies who, in total, control more than 30% of the multifamily housing units in the city, according to the complaint. The complaint also alleges that RealPage targeted specific areas across the district for their price recommendations, including areas close to AU.

According to the lawsuit, the companies allegedly shared data through RealPage Revenue Management software, which provided them with price-setting recommendations that allowed the companies to not compete with each other as they would in a fair market.

The lawsuit involves at least 58,000 units in buildings with more than five units, called multifamily buildings. The complaint alleges the landlords use RealPage to set rent prices in more than 50,000 of these units.

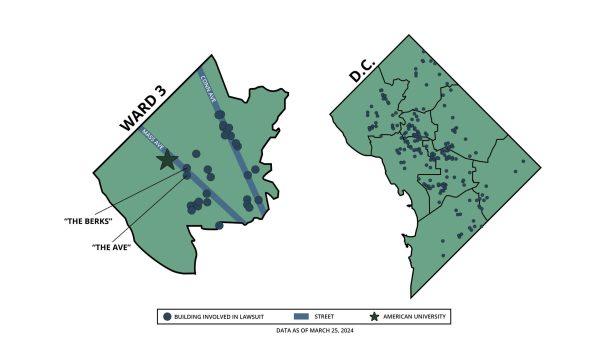

The attorney general’s office did not provide AWOL with a list of which of the 50,000 units controlled by these landlords had their rents set by RealPage, so it’s unclear which apartments are affected. However, the complaint alleges that RealPage specifically targeted apartments along Connecticut Avenue — where many AU students live due to its proximity to campus — as a submarket where it could control prices.

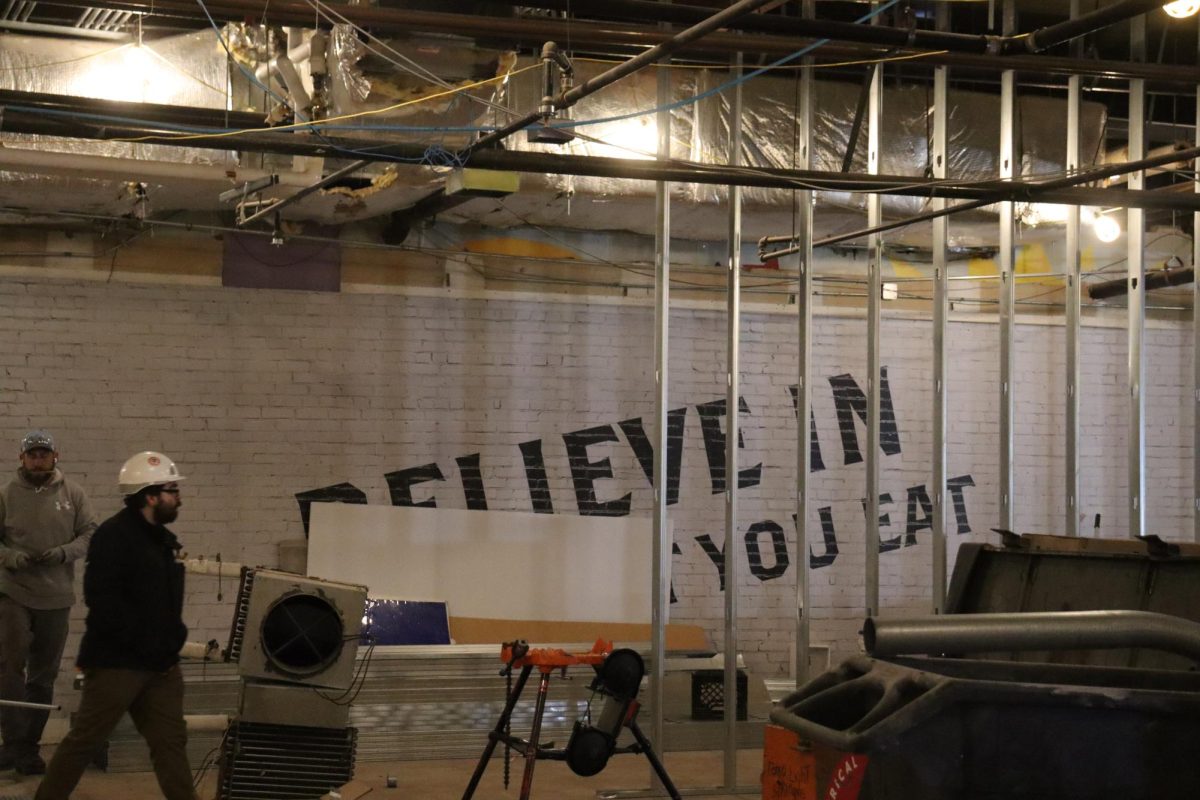

Among the apartments owned by companies involved in the lawsuit are the Berkshire Apartments, owned by Gables Residential, and the Avalon at Foxhall, owned by AvalonBay Communities, Inc. Neither the Berkshire Apartments nor the Avalon responded to requests for comment.

AvalonBay has filed a motion to be dismissed from the case, and Gables Residential denies the allegations presented in the complaint, according to its answer to the complaint filed on Feb. 20.

Both the Berkshire Apartments and the Avalon are recommended to students on AU’s Off-Campus Housing website.

“We provide a listing of off-campus housing options, so that students are aware of options in proximity to the university,” said Jasmine Pelaez, the internal communication manager for the Office of Communications and Marketing, in an email.

Even students living outside the targeted submarket described in the lawsuit are likely affected. The attorney general’s office did not respond to AWOL’s requests for an interview, but did provide AWOL with an academic paper cited in the complaint. The paper, from the University of Pennsylvania, used multifamily housing market data from between 2005 and 2019.

According to the paper, overall algorithmic pricing—like RealPage’s software—controlled between 25% and 30% of the market in 2019.

At that level of use, the paper states that the effects of algorithmic pricing could be felt across the market, even in units using other pricing methods. Those effects included higher rents and lower occupancy rates. The complaint states that “well over” 30% of apartments in multifamily buildings in Washington are priced through RealPage’s revenue management software.

These effects can be dire for renters, especially students, said Brandon Weiss, a professor of law at AU’s Washington College of Law.

“Students face their own unique challenges in affording housing,” Weiss said. “And so while this is clearly likely to have an impact on renters in general, I’m sure the students will be disproportionately affected as well.”

Govindaiah said she thinks this makes college students more vulnerable to the kind of practices Gables Residential and the other defendants are being sued for.

“I do think students are just going to be disproportionately targeted by that because they know they can increase the rent the maximum amount, and they know students will still pay it because they know people want to live close to campus,” Govindaiah said.

After her first year at the Berkshire, Govindaiah said that Gables Residential attempted to raise her rent by 8.9%. In the end, it only increased by 6% because of a D.C. Council emergency bill that capped the rate at which some units rent could be raised across the district, including units in the Berkshire.

AU Senior Lindsey Ricci, who lives in the Avalon, said she received a notice in March that her rent would go up by $411 should she renew her lease. She said the over 20% increase has made her unsure of whether she’ll be staying at the Avalon another year.

“I’m pretty angry,” Ricci said. “I already pay a good amount to live here a month.”

In an already poor housing market, RealPage’s software has only made things worse, said Weiss, who specializes in housing and real estate law. Over 35% of renters in Ward 3 spend 35% or more of their household income on rent, according to AWOL’s calculations based on the U.S. Census Bureau survey estimate from 2017 to 2021.

“The alleged price-fixing and collusion here that likely has been increasing rents across the market are just exacerbating already pre-existing difficult market conditions for renters in the district and nationally,” Weiss said.

The attorney general’s case is still in its early stages, and the next hearing is scheduled for May 31. RealPage is a defendant in over 20 other lawsuits across seven states for its revenue management software, Greystar Real Estate Partners, LLC. is listed as a defendant in 19 of those lawsuits. As of March, Greystar has 28 properties listed on its “Apartments for Rent in Washington DC” webpage, including the Ellicott House and the Barton at Woodley in Ward 3, according to AWOL data collection on the Greystar website.

One case, Navarro v. RealPage, Inc., accuses RealPage and several landlord companies, including Greystar, of colluding to inflate the rent prices of specifically student housing across the U.S. The case’s complaint alleges that the student housing market is particularly susceptible to price setting because of the specific challenges students face as renters — particularly, their lack of alternatives.

AvalonBay has been named in about half of the lawsuits, according to AWOL’s analysis. Although AvalonBay was originally named in the lawsuit as a defendant, it is arguing the company should not be in the lawsuit.

In a motion to dismiss the attorney general’s complaint, the company stated that AvalonBay’s contract with RealPage specifically states that RealPage would not use AvalonBay’s data to recommend prices to other landlords nor would it use other landlords’ data to recommend prices to AvalonBay.

According to RealPage’s website, revenue management technology was first used in the multifamily housing industry in the early 2000s, and has represented larger shares of the market since then. Although the technology is new, justice departments are still intent on prosecuting companies, Wiess said.

“Here even the Department of Justice is saying that the use of algorithms does not excuse behavior that otherwise would be deemed illegal under our laws,” Weiss said.

RealPage’s revenue management software uses client-supplied data to create rent recommendations, according to the complaint. The software automatically accepts and applies rent recommendations, but even when the feature is disabled, the complaint alleges that landlords can not easily deviate from RealPage’s suggestion.

Instead, the landlord must submit a written business justification for why they wish to override the software’s recommendation. Even then, RealPage rarely accepts landlords’ proposals to override, “except in extenuating circumstances such as a natural disaster,’’ according to the complaint.

The complaint alleges that RealPage measures landlords’ compliance and identifies landlords that frequently deviate from RealPage’s recommendation as targets for additional training and “strategy alignment,’’ or programs to push the landlords back toward RealPage’s recommendations.

For example, when a new company begins working with RealPage, the complaint alleges that RealPage will secretly inquire about properties, referred to as secret shops in the lawsuit.

“This process tests whether the landlords’ employees are, in fact, offering only RealPage-generated rents even in the event that a prospective tenant attempts to negotiate,” according to the complaint.

Because of these RealPage policies, participating landlords use the RealPage price recommendation more than 90% of the time, according to the complaint.

Many students live in rent-controlled apartments, so there is a legal limit to how much their rent can be raised, said Rohin Ghosh, the co-president of AU’s chapter of Young Democratic Socialists of America and the commissioner for ANC3E-08. The most these students can do to resist the effects of revenue management is to make sure their rent increase is legal, Ghosh said.

However, even if students aren’t able to fight a rent increase, they can still organize around other tenant issues, Ghosh said.

“If you have mold, if your heat isn’t working, your hot water isn’t working, like whatever it may be, that’s not something you just have to put up with,” Ghosh said.

For students trying to take the first step in tenant organizing, Ghosh said they can start by reaching out to neighbors in the building, who are likely experiencing similar issues. Collective action, supported by outside tenant rights organizations like YDSA or Empower DC, can help tenants create change within their building and even other buildings owned by the same company, Ghosh said.

“If the company gets bigger, the union also has to get bigger,” Ghosh said. “That goes in the workplace. It also goes at home.”

Weiss said that he encourages tenant organizing as a way for tenants to build power and motivate the government to intervene. He said the Homes Guarantee campaign from People’s Action is another advocacy group tenants could join to make change.

“Another thing that tenants can do in buildings that are effective is join the ever increasing and burgeoning tenant organizing and tenant rights movement, in the district, in their local city, nationally,” Weiss said.

Ghosh said joining tenant rights organizations is even more essential now when corporate consolidation in the housing market has escalated rapidly. As the situation becomes progressively more difficult, Ghosh said tenants become increasingly willing to fight back, which can be used as a force against unaffordable rent prices and poor conditions.

“I think it’s a question of which of those forces are going to be stronger?” Ghosh said. “And that’s not a fact of nature, which one is going to be stronger. That’s decisions that we make.”

Editor’s Note: To see a full list of apartments in D.C. owned by companies in the lawsuit and the data work reporters did for this story, click here.